Spring Property & Market

Welcome to Spring and our latest market update.

Perth 101 - a quick snapshot of Perth Property

Rate cuts & Borrowing Power

Help for First Home Buyers - Finally!

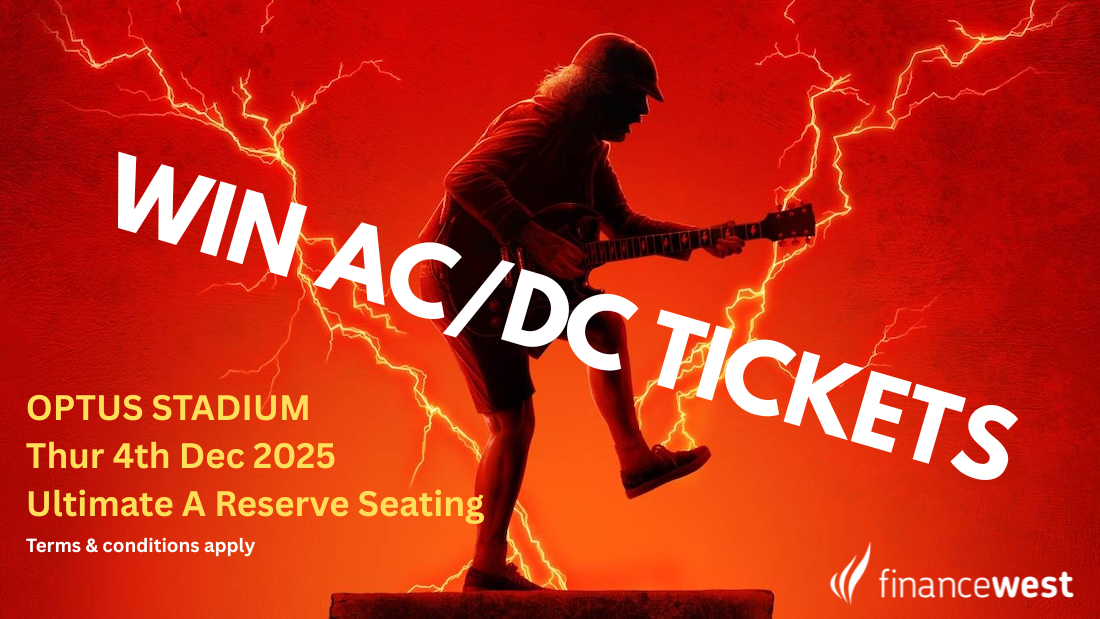

WIN AC/DC TICKETS! You might already be in the draw!

Read on for the latest news.

Interested in what’s happening in Perth specifically?

Here is a couple of important points to understand where the market is at and why so strong :

1. Perth’s Median values for a 4x2 home – according to REIWA week ending 14th September 2025

House price $870,000

Rental cost / income $730pw

2. Housing activity – Perth Metro.

There are only 2,430 homes for sale this week! Demand is significantly outstripping supply. That’s compared to:

13,600+ when supply and demand are equal (last seen 2019)

Down from 5000+ at the end of 2024. However, to be fair this was temporary, while buyers waited for State and Federal election outcomes.

The previous notable low was August 2024 (3,104). We are -20% lower!

Clearly. This means there is significant pressure on Property values to continue to increase. We are still not building enough houses for demand either.

……And when you see the next 2 articles, you will see there is petrol being thrown on the fire, for property values to continue this trajectory.

The RBA has recently reduced our interest rates, which I’m sure was welcomed by everyone. There is even an exception to expect another rate drop, perhaps in November this year, and another early next year.

…… which means I have Good News & Bad News for you.

THE GOOD NEWS

With interest rates getting lower, that means you can borrow even more money to get your dream home, or maybe buy that investment property you’ve been thinking about.

THE BAD NEWS

Everyone else in the country that you are competing against to buy that house or investment property also had their borrowing capacity increased.

If you would like to discuss your options to buy a new home or Investment property, talk to one of our experts now about how to get preapproved to be ahead of the competition and get your offer accepted.

Note. Some banks will be more favourable depending on your circumstances, and we can help get the right fit to maximise your chance of approval and maximise your borrowing capacity.

As property values have soared over recent years, there has not been a lot of changes to the level of Government support for first-home buyers, who are struggling to get into the market.

UNTIL NOW.

Last week, the Federal government announced some helpful changes to their National First Home Owner Guarantee scheme starting 1st October 2025

The key points being:

The Government will guarantee 95% of the property value, up to $850,000 in Perth ($600,000 outside of metro). This will avoid Lenders Mortgage Insurance (LMI) altogether, saving tens of thousands of dollars.

They have removed income caps. So regardless of your income, if you are an eligible first home buyer, you will qualify

So who is eligible? Contact a Financewest expert to be sure, but the key criteria is:

- Are you >18 years old, & an Australian Citizen or Permanent Resident?

- You (or your partner) have never owned a home in Australia before?

Example: If you wanted to buy a home in Perth for $600,000, you would need just a $45,000 deposit in total, including Stamp Duty. Or, for a $700,000 purchase, you would only need a $63,000 deposit in total.

NOTE - This also means there will be significantly more activity and pressure on property prices below $850,000 from the 1st October.

AC/DC is coming to Optus Stadium on Thursday, 4th December 2025 and the team at Financewest has secured a couple of premium "Ultimate A-Reserve" seats for a happy customer.

To be in the draw, all you need to do is:

Settle a loan, or get an Unconditional Approval with Financewest between 1st August 2025 and 30th November 2025.

Receive a bonus $200 Crown voucher if you’ve also left a Google review for us from your recent experience.

Winner will be notified by Facebook & Instagram on Monday, the 1st December 2025, so please make sure you Like us on both to see if you’ve won!

So if you’ve been thinking about any of the following – Let's start the process now and get you in the draw!

a) Buying your First home? We can hold your hand through that whole process and make sure you know all of the new government support options available.

b) Refinance your existing loan to get a much better rate to shave years off your loan. More importantly, potentially save tens of thousands in interest over the life of your loan.

c) Looking to buy an investment property with the equity in your home? We can help with that, too. Often, you don’t need any cash to put towards the purchase.

d) Need any new vehicles or equipment for your business? We can help get you the best deal, or even set up Pre-Approved lines, depending on what you need

e) Did you know you can use your SMSF to buy property? It can be tricky with all the government regulations and lender criteria. Speak to the experts today to find out more

Thanks for your time to check out what I feel is an easily digestible wrap-up, on what you need to know about your biggest investment.

If you would like to discuss any of those topics, Please reach out to the team at Financewest anytime.